Mortgage After Bankruptcy: Understanding the Impact

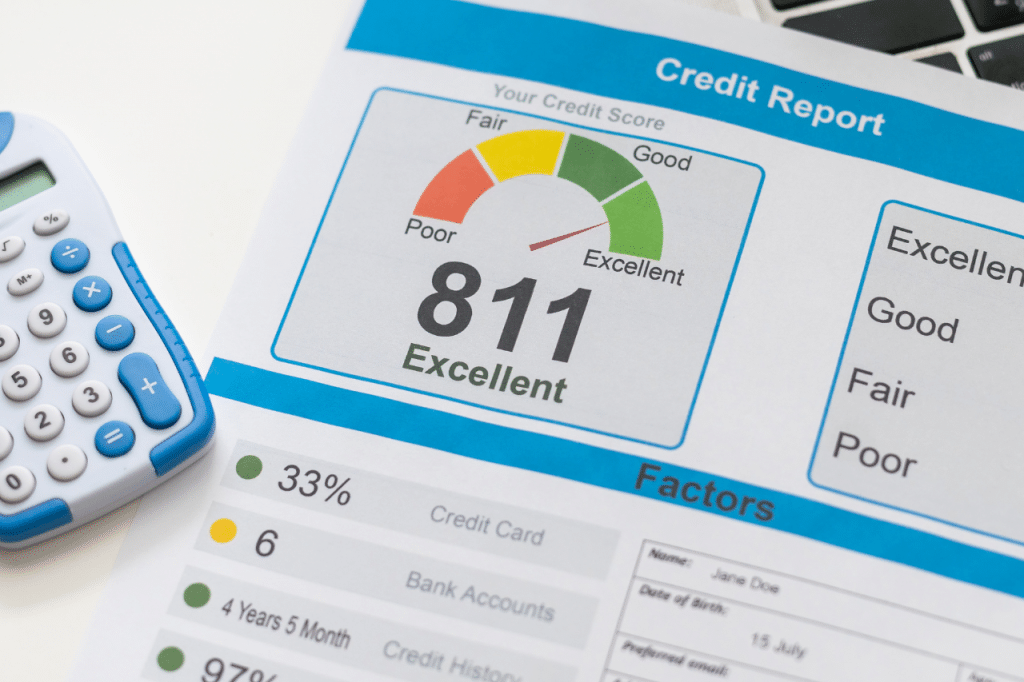

So what does your mortgage after bankruptcy look like? Going bankrupt will seriously impact your credit score. As a result, it will make it very difficult for you to get approved for a mortgage until your credit rating improves.

You will remain bankrupt for 12 months. During this time, you will not be able to apply for a mortgage.

Once you are discharged – after the year of your bankruptcy – you will be able to start rebuilding your credit rating. You can often assist this process by using a so-called credit repair credit card.

2-3 years after the date you originally went bankrupt, you will start to become eligible for bank loans and other forms of unsecured credit. At this time, there may also be some specialist lenders who might consider giving you a mortgage. However, they will charge much higher rates of interest than standard high-street lenders.

You will not be eligible for a mortgage from a high street lender (for example Nationwide, Barclays and Halifax) until the record of your bankruptcy has been fully deleted from your credit file. This will happen 6 years after the start date.

What Factors Affect Getting a Mortgage After Bankruptcy?

After you have gone bankrupt, there are a number of things that will impact your ability to get a mortgage:

Steps to Improve Your Chances of Getting a Mortgage After Bankruptcy

1. Rebuild your credit score

There is little you can do to start rebuilding your credit score until you are discharged from bankruptcy. Once your bankruptcy is over, you can consider the following suggestions:

Start building a record of responsible credit usage – To do this you will need to start using a so-called credit repair credit card. You should ensure that the balance of your spending is paid off IN FULL at the end of each month.

Fix any mistakes or inaccuracies on your credit file – You need to get a copy of your credit file. The lenders included in your bankruptcy will still be recorded. However, they should change the account status to ‘partially satisfied’. Where this is not the case you can demand that they make the change.

2. Wait the required time

You will normally have to wait 2-3 years from the date your bankruptcy ends before you are eligible for a sub-prime mortgage.

Applications for a high street mortgage will not normally be accepted until 6 years from the start date of your bankruptcy.

3. Work with a specialist mortgage broker

If you want to apply for a mortgage after bankruptcy, it is important to get the advice of a specialist mortgage broker. Such a broker understands the market and which lenders are likely to accept your application.

Where the record of your bankruptcy has now come off your credit file, using a specialist broker is still advised. Even at this stage, not all high street lenders will be willing to lend to you. Your broker will advise which deals are available to you.

A mortgage broker will charge you a fee for their work. Contact us for advice about specialist mortgage brokers.

4. Get together as big a deposit as you can

Making a sizable deposit will greatly increase your chances of being approved for a mortgage. Most lenders will require a minimum deposit of at least 10%. However, if you want to use a sub-prime lender, this may need to be increased to 25%

Even if you wait to use a high street lender, offering a deposit of more than 10% will significantly widen the mortgage options you have and will potentially lead to more favourable interest rates.

Mortgage After Bankruptcy Frequently Asked Questions

Bankruptcy Guide For Mortgage After Bankruptcy Advice

Although going bankrupt might be a setback in terms of your finances, it doesn't have to stop you from achieving your goal of becoming a homeowner.

Once you are discharged, you can improve your chances of getting a mortgage and realising your dream of home ownership by being proactive in repairing your credit, saving for a deposit, and choosing the correct lender.

Get in touch with us at Bankruptcy Guide today to receive full support throughout the whole bankruptcy process. We ensure you know exactly what you’re doing and where you are at every stage. Our service does not just include submitting your application. We continue to support you through the year you are bankrupt.

In addition, once you are discharged, we are here to offer advice about credit repair and getting yourself in the best position to apply for a mortgage.